How Nonresident Aliens Pay Their Taxes

Reading Time: 2 minutes According to Internal Revenue System, Nonresident aliens are individuals who are not a U.S. citizen or U.S. national and wasn’t able to pass the green card test or the substantial presence test. Nonresident aliens are international students who are currently studying in the United States, international students who need to obtain practical training that is…

According to Internal Revenue System, Nonresident aliens are individuals who are not a U.S. citizen or U.S. national and wasn’t able to pass the green card test or the substantial presence test. Nonresident aliens are international students who are currently studying in the United States, international students who need to obtain practical training that is not available in their home country to complete their academic program, and international investors who are doing business in the United States.

At Green Ocean Property Management, we work with a ton of international investors. A lot of our investors don’t have social security numbers. When you’re located in the United States, and you have a security number, you’re expected to pay taxes, especially rental income. If you’re an international investor, and you don’t have a source of security number, we can help you.

Process for Nonresident Aliens

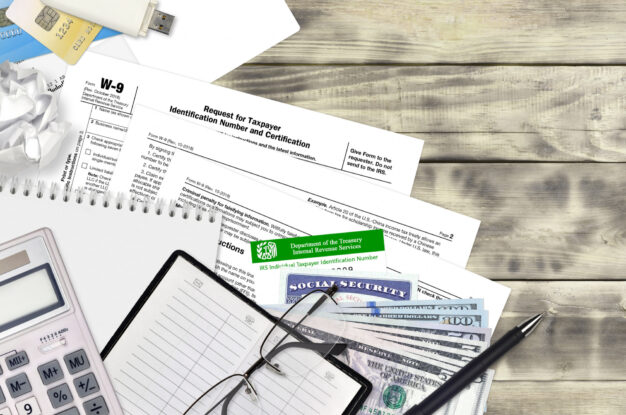

Step 1 – Fill out a W-8 Form

W-8 Form is just like a W-9. In Massachusetts, we submit W-9, which contains all your tax information and the income that you’ve made at the end of the year.

Step 2 – Get an Individual Taxpayer Identification Number (ITIN)

ITIN is a tax processing number issued by the Internal Revenue Service. The IRS issues ITINs to individuals who are required to have a U.S. taxpayer identification number but who do not have, and are not eligible to obtain, a Social Security number (SSN) from the Social Security Administration (SSA).

We work with both CPAs and lawyers to help international investors obtain ITIN. If they really want to try to get a social security number, they can. They just need to fill out the the 1099 form. If they do not have that, we have to withhold up to 30% of the actual rental income. Afterward, we have to provide the 1099 form to the government every single quarter. This is more work for us as a property manager, but we want to make sure that you’re going to be compliant with thec mandated by the United States.

If you or anyone else you know is looking for a property manager that understands the financials and obligations of working with international clients, please think of Green Ocean Property Management, where you get more than a property manager, you get peace of mind.

Introducing Asana and the On-ramping Process

Reading Time: 9 minutes Asana is one of the project management tools we use to help us serve you well. In today’s article, we take you on a virtual tour of the Asana interface – starting with the on-ramping process – showing just how much we go above and beyond to invest in state-of-the-art tools that allow us…

Creating a Safe Haven: Essential Security Measures for Your Rental Properties

Reading Time: 5 minutesAs a property owner or manager, providing a safe and secure environment for your tenants is not just good practice, it’s essential. A property with strong security measures not only protects your tenants and their belongings but also offers peace of mind for you and can even enhance the value of your investment. Securing…

How Regular Cleaning Services Can Improve Tenant Satisfaction

Reading Time: 4 minutesTenant satisfaction is a cornerstone of successful property management. Happy tenants are more likely to renew their leases, take care of their units, and recommend the property to others. One key aspect that significantly contributes to tenant satisfaction is the cleanliness of the living environment. Regular cleaning services are vital in maintaining a clean, healthy,…