Exploring the Best Areas for Your Next Investment: A Guide to Making Informed Decisions

Reading Time: 4 minutesChoosing the right location is paramount to the success of any investment, and real estate is no exception. Whether you’re a seasoned investor or just starting out, selecting the ideal area can significantly impact your returns and overall experience. This guide will equip you with the knowledge and tools to explore potential investment areas and…

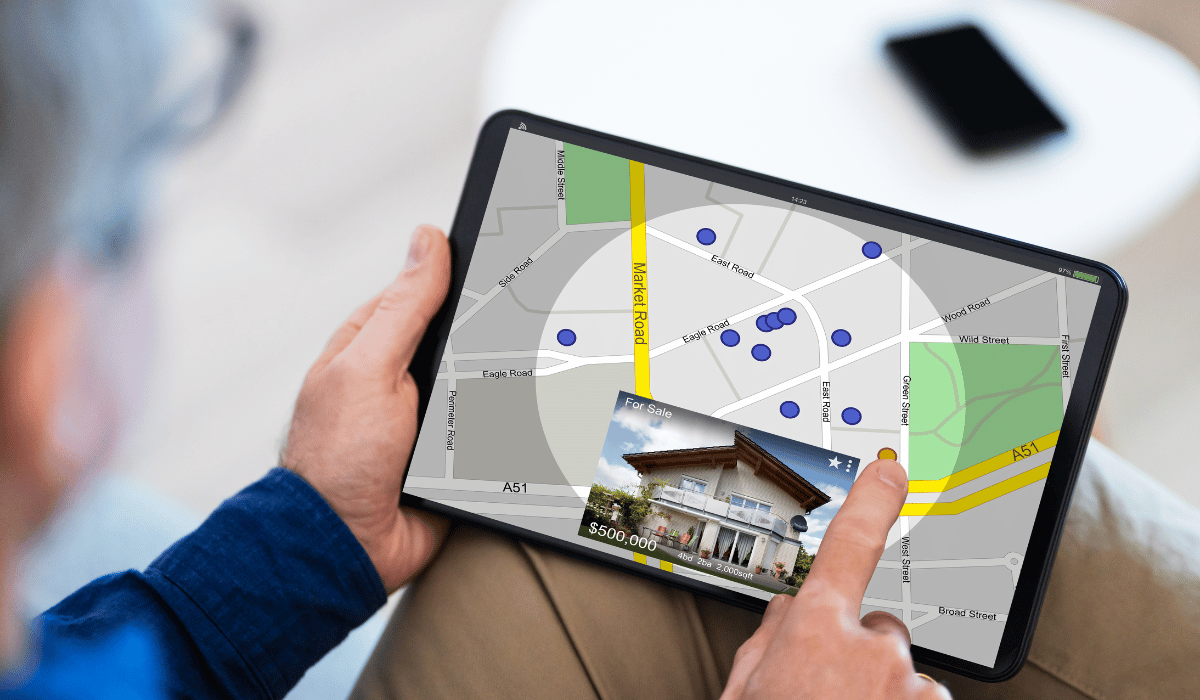

Choosing the right location is paramount to the success of any investment, and real estate is no exception. Whether you’re a seasoned investor or just starting out, selecting the ideal area can significantly impact your returns and overall experience. This guide will equip you with the knowledge and tools to explore potential investment areas and make informed decisions that align with your financial goals.

Table of Contents

Define Your Investment Goals

The first step is to identify your investment objectives. Are you seeking high capital appreciation, aiming for a steady stream of rental income, or perhaps a combination of both?

Growth vs. Income

- Growth Investors: If your primary goal is maximizing property value over time, prioritize areas with high projected growth potential. These areas often have characteristics like a booming job market, new infrastructure developments, or revitalization projects.

- Income Investors: For those prioritizing consistent rental income, established neighborhoods with stable populations and strong rental demand are ideal. Look for areas with a healthy mix of businesses and residential properties, indicating a diverse and reliable tenant pool.

Short-Term vs. Long-Term

Consider your investment horizon. Are you looking to “flip” a property for a quick profit, or are you interested in holding onto the property for long-term wealth creation? Factors like market trends and property types can influence your decision.

Understanding Your Risk Tolerance

Investment inherently involves risk. The key is to find a balance between potential returns and the level of risk you’re comfortable with.

Generally, higher potential returns come with greater risk. Emerging markets may offer significant growth opportunities, but they can also be more volatile due to factors like political instability or economic uncertainty. Established markets, on the other hand, offer more predictable returns but may have lower growth potential.

Research Potential Investment Areas

Once you understand your goals and risk tolerance, it’s time to delve into researching potential investment areas. Here are some key factors to consider:

Market Analysis

- Job Market: A strong and growing job market is a strong indicator of future population growth and potential for rental demand. Research local employment trends and the presence of major employers in the area.

- Economic Indicators: Look beyond just rental rates. Analyze economic factors like unemployment rates, average wages, and overall economic growth within the target area.

- Real Estate Trends: Stay informed about local real estate trends. Are property values rising steadily? Are rental rates increasing? Understanding these trends can help you predict future performance.

Local Regulations and Taxes

Don’t overlook the impact of local regulations and taxes on your investment. Research zoning laws, permitting processes, and property taxes in your target area. These factors can significantly impact your investment returns and overall profitability.

Consider the Property Type

The type of property you choose can also influence your investment strategy. Here’s a brief overview of two common options:

Single-Family Homes vs. Multi-Unit Properties

- Single-Family Homes: Generally easier to manage for individual investors, but they may offer lower overall returns compared to multi-unit properties.

- Multi-Unit Properties (duplexes, triplexes, apartments): Can generate higher overall income due to multiple rental streams, but require more management effort and potentially involve hiring property management services.

Commercial vs. Residential Properties

- Commercial Properties (office buildings, retail spaces): Can offer higher rental rates due to typically larger spaces, but may be more susceptible to economic downturns that impact businesses.

- Residential Properties (single-family homes, apartments): Generally offer more stable rental income but may have lower growth potential compared to commercial properties.

Conducting Due Diligence

Once you’ve identified a promising area and property type, thorough due diligence is crucial before making any final decisions.

- Neighborhood Research: Research the specific neighborhood within your target area. Look for safe and secure neighborhoods with good amenities like schools, parks, and shopping centers. Consider the potential for future development that could positively impact property values.

- Property Inspections: Never underestimate the importance of professional property inspections. Hire a qualified inspector to identify any structural problems, potential code violations, or maintenance issues with the property.

Conclusion

Investing in real estate can be a powerful wealth-building strategy. By thoroughly researching potential investment areas, understanding your risk tolerance, and conducting proper due diligence, you can increase your chances of making sound investment decisions. Remember, seeking professional advice from financial advisors or experienced real estate agents can be invaluable throughout the process.

With careful planning and a well-defined strategy, you can find the perfect investment location to achieve your financial goals.

Finding the perfect location is just the first step

Managing your properties effectively is crucial for maximizing your returns and minimizing stress. That’s where Green Ocean Property Management comes in. We are a team of experienced property managers dedicated to helping investors like you achieve their financial goals. Whether you’re a seasoned investor with a growing portfolio or just starting your real estate journey, we can handle all the day-to-day management tasks so you can focus on what matters most.

Contact Green Ocean Property Management today for a free consultation!

How Technology is Revolutionizing Property Management in Boston

Reading Time: 4 minutesAre you a property owner or investor in Boston curious about the future of property management? In today’s blog, we’ll discuss how technology is revolutionizing property management in Boston. Let’s start exploring the exciting developments on the horizon through trends and innovations. Trend 1: Smart Home Technologies Integrating innovative home technologies like automated…

How to Market Your Investment Property to a Wider Audience

Reading Time: 4 minutesAre you a real estate investor in Boston, Massachusetts, looking to attract a wider audience for your investment property? Effectively marketing your property is essential to maximize its visibility and reach potential tenants who may be the perfect fit for your rental units. You can expand your reach and draw a broader audience by implementing…

Avoid these Common Landlord Mistakes

Reading Time: 3 minutes Mistakes after mistakes after mistakes can be done. A property manager’s job is to help you minimize common landlord mistakes and more importantly, avoid them before they even happen. Here are three of those common mistakes and why you should prevent them. #1 Not recognizing the importance of planning First and foremost, prior…