Understanding the Impact of Inflation on Rental Properties

Inflation is a fundamental economic concept that refers to the general price increase and decreased purchasing power over time. Understanding how inflation affects rental property owners’ investments is crucial. While inflation can present challenges, it offers opportunities if managed effectively. This article explores the impact of inflation on rental properties and provides strategies to navigate…

Inflation is a fundamental economic concept that refers to the general price increase and decreased purchasing power over time. Understanding how inflation affects rental property owners’ investments is crucial. While inflation can present challenges, it offers opportunities if managed effectively.

This article explores the impact of inflation on rental properties and provides strategies to navigate these changes.

Table of Contents

How Inflation Affects Rental Property Owners

Inflation can significantly influence various aspects of owning and managing rental properties.

Increased Operating Costs

Inflation often leads to higher operating costs for property owners. These include:

- Property Taxes: Property taxes tend to increase as property values rise with inflation.

- Utilities: The cost of utilities such as water, gas, and electricity typically rises during inflationary periods.

- Maintenance and Repairs: The prices for materials and labor needed for maintenance and repairs also increase.

- Insurance Premiums: Insurance companies may raise premiums to keep up with inflation.

Rising Property Values

Inflation generally results in higher property values. This can have both positive and negative effects:

- Potential Benefits of Increased Equity: As property values rise, so does owners’ equity in their properties.

- Impact on Property Taxes: Higher property values can increase property taxes, affecting overall profitability.

Tenant Affordability

Balancing rent increases with tenant affordability is a key challenge during inflation:

- Balancing Rent Increases with Tenant Retention: While raising rents may be necessary to cover increased costs, it’s important to do so without driving tenants away.

- Impact on Tenant Turnover: Significant rent increases can lead to higher tenant turnover, increasing vacancy rates, and reducing rental income.

Strategies for Managing Inflation

Effective strategies can help rental property owners manage the impact of inflation.

Rent Adjustments

Adjusting rents appropriately can help maintain profitability. Regularly analyze the local rental market to ensure rent increases align with current trends. Consider incorporating rent escalation clauses into lease agreements for periodic rent increases.

Cost Control Measures

Implementing cost control measures can mitigate the impact of rising expenses. Investing in energy-efficient appliances and systems can reduce utility costs. Negotiate with vendors and service providers to secure better rates. Regular preventive maintenance can help avoid costly repairs in the future.

Hedging Strategies

Diversification and hedging can protect against inflationary pressures. To reduce risk, spread investments across different asset classes. Consider investments linked to inflation indices.

Tax Implications

Take advantage of tax deductions and credits to offset increased costs. Ensure you are fully utilizing available deductions and credits to reduce taxable income.

Opportunities in an Inflationary Environment

Despite the challenges, inflation can also present opportunities for rental property owners:

- Potential for Increased Rental Income: Higher rents can increase rental income.

- Appreciation of Property Values: Property values generally appreciate during inflationary periods, increasing overall asset value.

- Tax Benefits: Inflation can enhance the value of certain tax benefits and deductions.

- Attracting Long-Term Tenants: Offering stability in rent increases can attract and retain long-term tenants.

Conclusion

Inflation can significantly impact rental property investments, but with proactive management and strategic planning, property owners can navigate these challenges and potentially benefit from rising costs. Understanding the effects of inflation and implementing effective strategies are essential for maximizing rental property investments.

Green Ocean Property Management can help you navigate the complexities of inflation and maximize your rental property investment. Contact us today for a consultation and take the first step towards securing your financial future in an inflationary environment.

The 10 Best Financial Reporting Software Tools for 2024

Managing properties is a juggling act. You’re keeping tenants happy, responding to maintenance requests, and making sure everything runs smoothly. But when it comes to financial reports, those trusty spreadsheets can turn into a nightmare. Endless rows of numbers, manual data entry, and the constant fear of errors – it’s enough to make any property…

How to Make Your Multi-Unit Property Stand Out

In the competitive rental market, property managers must go beyond the basics of providing a roof over residents’ heads. Amenities play a crucial role in differentiating multi-unit properties, enhancing both resident experience and property value. As more individuals seek a place that offers comfort, convenience, and community, the right amenities can make a property significantly…

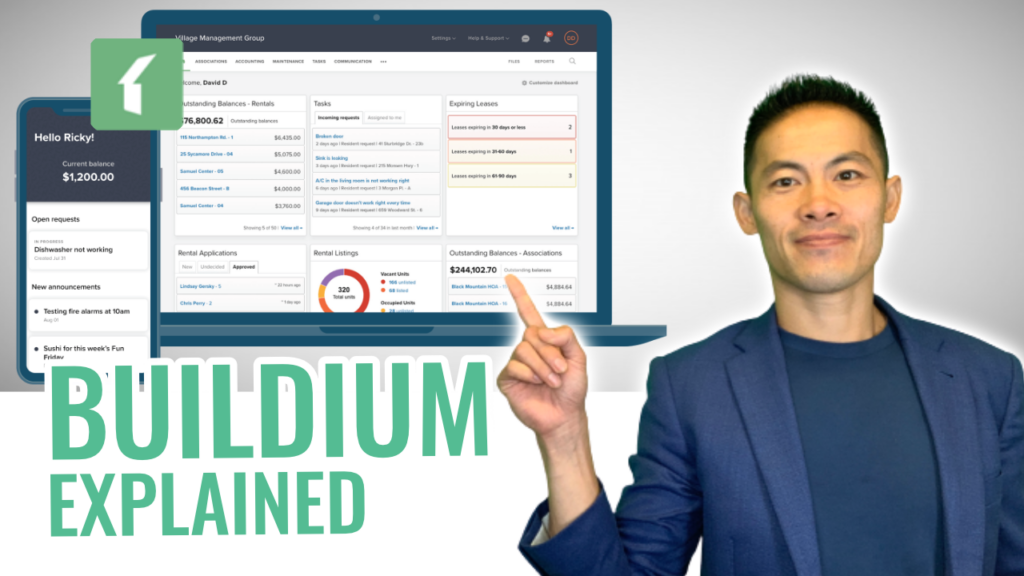

How to Get Started with Buildium

Proper documentation of billings and leases is important to every landlord. We provide that in real-time using Buildium, a property management software that makes our operations easier. So in today’s video, we are showing you Buildium: what it looks like and how to get started with it. What is Buildium Buildium is a…