Why Should You Put Your Property into an LLC?

Reading Time: 3 minutesYou’re ready to invest in a property, but you are concerned about the liabilities that come with renting it out. Should put your property into an LLC? Here are some Having as much protection as possible is incredibly important, but it comes at a cost. So many individual landlords might start with one property,…

You’re ready to invest in a property, but you are concerned about the liabilities that come with renting it out. Should put your property into an LLC? Here are some

Having as much protection as possible is incredibly important, but it comes at a cost. So many individual landlords might start with one property, and purchase it individually under their name only to be told they can’t switch it under an LLC. In the end, they decide to keep it but forget about it. If something happens, they might get sued and they will be personally liable for it.

Having an insurance policy with an umbrella might be able to cover you to a higher limit. Typically, the master policy might cover you, but when things get really bad, you need to have that additional layer of protection. That is what a putting your property in a Trust or an LLC may do.

Let’s know more about LLC

LLC stands for Limited Liability Corporation. What it does is create a separate tax ID. He pays about $500 a year to be able to renew the LLC as well as to provide the cost of any type of tax return that’s necessary to file the separate corporation that he has now created.

You may say that there are a lot of costs involved in doing it. Yes, there is an upfront cost with an attorney, or you can do it yourself. It is pretty simple, but again we always suggest seeking help from an attorney. We have great ones that we can refer to you.

After he purchased his property, he puts it in LLC, and then he gets an insurance policy. Once he created an LLC, he will ask for help from an attorney to have an additional layer of protection so if something happens at the property, it goes against the insurance policy of the actual business itself. The business itself may be charge rather than him. They can always still come after you, but it’s just that additional layer of protection that you might have. You might say, “Well how many properties do I put into LLC? One or two?” It depends on your risk factor.

Expert advice that you should take note of

What we usually do is put two or three properties in each LLC. It depends on the size of the properties. If the property is much larger, we might just put one. If they’re smaller, two or three units or condos, we might put multiple. It just depends on your risk. Our founder, Jarrett Lau, only has two or three and he will create one, so he has several LLCs. Each one again has its insurance policy, tax ID, and its tax return. But it does add those layers of protection. And of course, your property should be able to be profitable enough to be able to have offset these costs that are involved with it. With this, the protection that you have is invaluable.

Our commitment

If you or anyone else you know is looking for a property manager to help protect you and think proactively to guide you through the steps of putting your properties into LLC or trust, please think of Green Ocean Property Management: where you get more than a property manager, you get peace of mind.

Is Room Rental a Good Idea?

Reading Time: 3 minutes With many landlords still facing vacancy, they’re continuing to drop prices, pay fees, but then they don’t know what to do afterwards. Let me explain what a room rental is. Instead of having your entire apartment rented out, whether it’s a two or three-bedroom apartment rent it out to an entire group. What…

Why Should you Ask for tenants’ landlord reference and work verification

Reading Time: 2 minutes One of the most common questions that we get is, “Are landlord and work verification necessary?” Back in the day, anything that we can do to pre-emptively determine if your tenants are going to be a good one or not, we’re going to do it for you. Prior planning prevents poor performance and learning how…

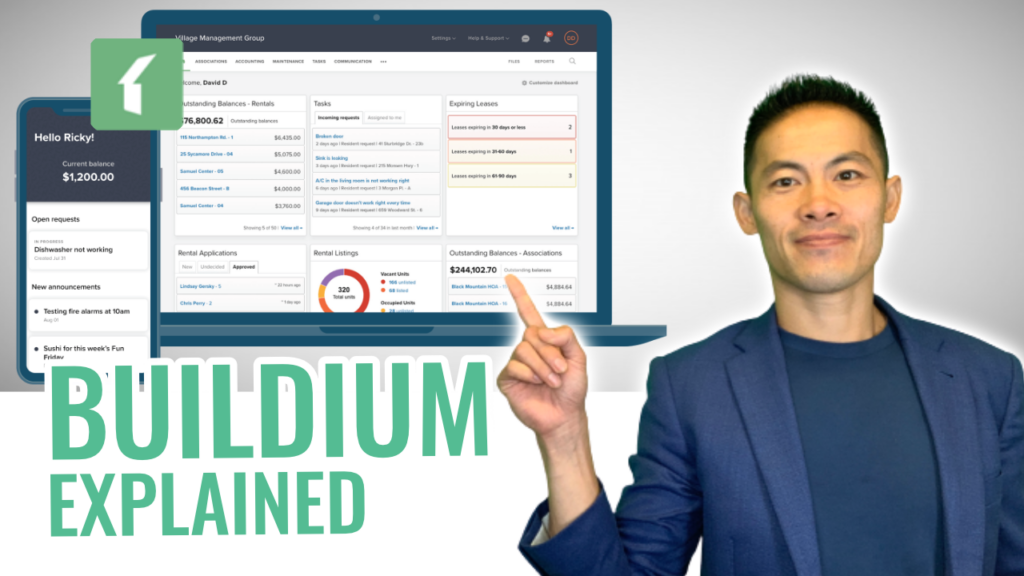

How to Get Started with Buildium

Reading Time: 3 minutes Proper documentation of billings and leases is important to every landlord. We provide that in real-time using Buildium, a property management software that makes our operations easier. So in today’s video, we are showing you Buildium: what it looks like and how to get started with it. What is Buildium Buildium is a…